By Katie Parente, Director Loan Review Services

The Current Expected Credit Loss (CECL) accounting standard will require consideration of not only past events and current conditions, but also reasonable and supportable economic forecasts that affect expected collectability. FASB ASC Topic 326 and the October, 2019 proposed Interagency Policy Statement on Allowances for Credit Losses does not prescribe a specific method for determining reasonable and supportable economic forecasts, nor does it include bright lines for establishing a minimum or maximum forecast period. As such, a significant degree of judgement is necessary. Guidance does, however, require forecasts to be consistent with managements’ forward-looking views and documented with sound, quantitative data and methods. This article focuses on a practical, cost-effective approach to forecasting for small to midsized non-complex financial institutions.

First, an institution’s system of internal controls should address the development and selection of economic and other assumptions used in CECL measurements. It should also address the appropriateness of accounting policies and procedures, especially those requiring the exercise of judgment.

Next, for each loan pool, an institution must select a forecast horizon deemed as “reasonable and supportable.” A two to three year forecast horizon is consistent with the guidance offered by most economic prognosticators and regulatory agencies such as the Federal Reserve. The nine-quarter horizon selected for stress-testing by the Federal Reserve further supports the notion that forecasts over this period are reasonable and supportable. Beyond this time frame the confidence intervals in any economic forecasting model will widen considerably.

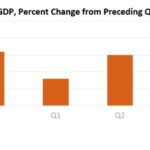

Once a forecast horizon has been established, management must decide on a set of key economic indicators that tend to correlate with the institution’s loan losses over time. Management is not required to search for all possible information, incur undue cost and effort to collect data, or use multiple economic scenarios. A good starting point is to identify key national/regional/local indicators such as GDP growth, unemployment rates, and housing prices.

An institution should choose an economic data source that is reliable and defensible, such as the Federal Reserve Economic Data (FRED) database maintained by the Research division of the Federal Reserve Bank of St. Louis (stlouisfed.org). This website has more than 500,000 economic time series from 87 sources on both a national and regional level. Auditors and Regulators will be hard pressed to argue with data published by the Federal Reserve! Local data, while limited, is available from state government websites and various publications. Whichever sources you choose, be consistent in their application so as to lend more credibility to the process.

Provided that forecasts are used as tools rather than crystal balls, they can provide users with the information needed to manage risk in a more quantitative, econometrically driven fashion. Over time, these tools will allow lenders to make more informed decisions along with complying with CECL for financial reporting.