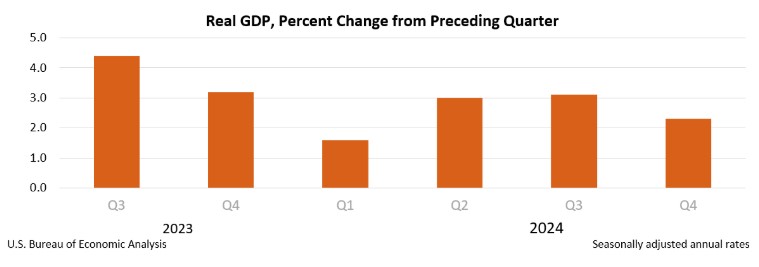

National Economy (4Q 2024 Advance Estimate)

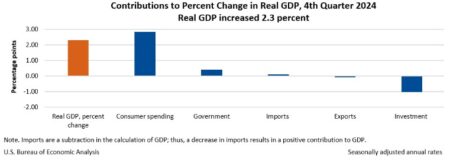

Real gross domestic product (“GDP”) increased at an annual rate of 2.3% in the fourth quarter of 2024 (October, November, and December), according to the advance estimate released by the U.S. Bureau of Economic Analysis. In the third quarter, real GDP increased 3.1%.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency.

The increase in real GDP in the fourth quarter primarily reflected increases in consumer spending and government spending that were partly offset by a decrease in investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Compared to the third quarter, the deceleration in real GDP in the fourth quarter primarily reflected downturns in investment and exports. Imports turned down.

The price index for gross domestic purchases increased 2.2% in the fourth quarter, compared with an increase of 1.9% in the third quarter. The personal consumption expenditures (“PCE”) price index increased 2.3%, compared with an increase of 1.5%. Excluding food and energy prices, the PCE price index increased 2.5%, compared with an increase of 2.2%.

GDP for 2024

Real GDP increased 2.8% in 2024 (from the 2023 annual level to the 2024 annual level), compared with an increase of 2.9% in 2023. The increase in real GDP in 2024 reflected increases in consumer spending, investment, government spending, and exports. Imports increased.