By Rick Elton, Managing Director of Sheshunoff & Co., Investment Banking

A volatile 1st quarter of 2022 came to a disappointing end, with major stock indexes suffering their worst performance in two years with other markets recording some of the most extreme moves on record. Inflation has surged to its highest level in 40 years, Russia’s invasion of Ukraine has rattled already stretched supply chains, and the Federal Reserve has embarked on a rate-increase plan whose pace has been challenging to estimate by investors.

Commodities finished out their best quarter in more than 30 years after Russia’s invasion of Ukraine supercharged the rally in markets from oil to wheat and nickel. The sharp run-up in commodity prices has both investors and economists concerned about inflation jumping even higher than current levels. Wheat has gained 31% this year to trade at its highest level since 2010, while core has added 26%, with a number of the metals also hitting new highs.

U.S. oil futures reached levels over $120 a barrel in early March, a level that flashed a warning for many economists, falling since then to a little over $100 a barrel at quarters end, but still recording the biggest quarterly gain since 2008. Economists worry that the increase in oil will dampen economic growth while also adding to inflationary pressures. The rally in oil prices has propelled gasoline prices to record levels, pinching consumers at the pump.

Adding to the uncertainty during the first quarter was the Fed’s plan to raise interest rates aggressively during 2022 to fight inflation. In doing so, the Fed removed a wave of stimulus that had driven stocks to dozens of record closes over the past two years and was a catalyst for investors to rush into some of the most speculative investments in the market.

Yields on short to medium term treasuries have logged their biggest quarterly gains in decades, with the two-year yield rising the most since 1984 and the five-year yield the most since 1987. The yield on the 10-year treasury ended the quarter at 2.324%, up from 1.496% at year-end 2021 and the record low of 0.501% early in the pandemic when many thought it would be years before the Fed once again raised rates.

With rates rising, the average rate for a 30-year fixed rate mortgage loans jumped to 4.67% at the end of the quarter, the highest level since December of 2018. At the beginning of 2022 the average rate on the 30-year mortgage loan was at 3.22%, moving higher at a faster pace than most analysts expected. Over time, the higher mortgage rates typically slow home buying activity while also reducing affordability at a time when many lower-income homes are already stretched.

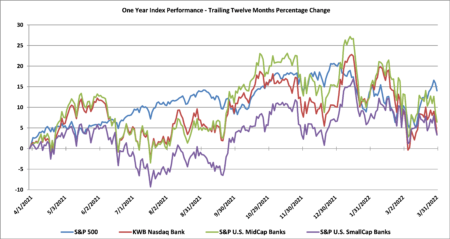

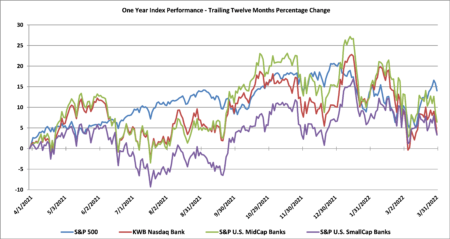

The KBW Nasdaq Bank Index posted a 6.1% decline during the first quarter of 2022 compared with the 1.4% rise in the fourth quarter of 2021. This index is now up by 3.3% over the past year and up by 32.7% over the past three year period. By comparison, smaller banks posted slightly better returns during the first quarter of 2022, with the S&P U.S. SmallCap Bank index decreasing by 3.2% in the quarter with the index being up by 3.3% over the past year while posting a three year rise of 29.1%. The S&P U.S. MidCap Bank index declined by 7.4% during the first quarter of 2022 compared to the increase of 3.5% during the fourth quarter of 2021 leaving it up by 6.4% over the past year and up by 47.0% over the past three years. By comparison, the S&P 500 was down by 5.0% during the first quarter of 2022 leaving it up by 14.0% during the past year. The S&P 500 was up by approximately 60.0% during the past three year period compared to the 32.7% rise for the KBW Nasdaq Bank Index and the 84.0% increase in the technology heavy Nasdaq. The Nasdaq decreased by 9.1% during the first quarter of 2022 and was up by 7.4% over the past year.