By: John Adams, Head of Investment Banking

2020 has been marked by extreme volatility in the market for public stocks. As a private bank, this is more than a passing interest. When privately owned banks have a need to transact their shares, setting a fair price is paramount. In some cases, the market for the bank’s stock is so illiquid that the bank itself stands in as buyer at a standard, informal price such as 1x book value per share. Depending on the market environment and trend in the bank’s performance, this could be undervaluing or overvaluing the shares. Either case tilts the transaction in favor of buyer or seller. A better practice is to establish a fair value of the shares on a regular basis through an independent appraisal, for example annually or quarterly depending on the frequency and volume of trades. In fact, the U.S. Department of Labor requires such periodic third-party valuations for the trustees who oversee transactions within an ESOP. The same concept should apply outside the ESOP to promote fairness and transparency, which brings us back to the recent volatile market for public bank stocks: these appraisals consider, among other factors, comparable publicly traded bank stocks to establish value with appropriate discounts for lack of marketability among other adjustments.

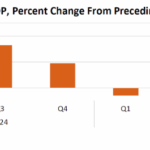

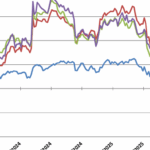

The recent trading environment for public bank stocks raises several questions. A price established at the end of 2019 might need to be reassessed given the changes in the industry, the decline in several bank stock indices by over 30% since year-end, and the changing economic landscape on both a micro and macro scale. In some cases, the volatility can be advantageous to private bank stock held by an estate. When an estate transfers shares or considers gifting shares, the IRS requires a value to be established at the date of the transaction, similar to an IRS requirement that a value be established at the date of death for shares owned by a deceased estate. These valuations can be contested by the IRS, which highlights the need for a formal appraisal that follows certain standards and can stand up to potential scrutiny. The advantageous aspect of a volatile first half of 2020 for stocks involves the depressed market prices around March 2020, which represent a relative low point in valuations. Estates can use this to their benefit to establish a value for purposes of taxes on transfers or gifting of shares.

Furthermore, with an election looming this year and a potential for tax policy changes, there is more reason for shareholders of private banks to consider their options relating to transfer of ownership. For shareholders who have already decided to pass ownership to their next generation, the current tax environment and depressed market prices earlier this year present an opportunity for tax planning. While tax planning should not be the determining factor, it is an influencing condition on the timing of a predetermined transfer of shares. Private banks and their shareholders should consult with their tax and legal advisors to understand the opportunities afforded by a volatile market.